Gambling bankroll formula in crypto

- David An

- Jul 29, 2025

- 1 min read

I am not a gambler so I only recently got exposed to Kelly Criterion in gambling. Lets apply to crypto.

First thing I asked myself is, how much should a crypto trader (not 24/7 trader) allocate to certain tokens.

Definition Bankroll: In gambling, it refers to the total amount of money a player has set aside specifically for betting or gambling. It represents the funds a gambler is willing to risk and manage over a certain period, separate from their regular finances.

The Kelly Criterion is a formula used to determine the optimal bet size in gambling and investing to maximize long-term growth while minimizing the risk of ruin. It helps bettors and investors allocate their capital efficiently based on their edge and the odds.

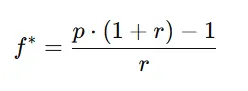

Formula:

Where:

f∗ = Optimal fraction of your portfolio to allocate.

p = Probability of price increase.

r = Expected return (percentage increase if the trade is successful).

1−p = Probability of failure.

Example calculation

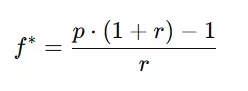

Let’s assume:

You estimate Bitcoin has a 65% chance of increasing.

You expect a 30% return if it succeeds.

There is a 35% chance of failure.

Since the result is negative, this means that, given these inputs, the investment is not favorable under the Kelly Criterion.

If the expected return was higher (e.g., 100% instead of 30%), the calculation would look like:

This would suggest investing 30% of your portfolio in Bitcoin

What do you think ? Have you used this formula for your crypto investment allocations ?

Comments